Roth ira withdrawal tax calculator

Buy Gold Investments from Top US Providers. If you withdraw money before age 59½ you will have to pay income tax.

A Roth Ira Conversion Is Probably A Waste Of Time And Money For Most

For some investors this could prove.

. Individuals will have to pay income. The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus. Your Age 5-Year Rule Met Taxes and Penalties on Withdrawals Qualified Exceptions.

You can withdraw contributions you made to your Roth IRA anytime tax- and penalty-free. 1 2024 to withdraw your Roth IRA. That is it will show which amounts will be subject to ordinary income tax andor.

This calculator assumes that you make your contribution at the beginning of each year. This condition is satisfied if five years have passed. First to avoid both income taxes and the 10 early withdrawal penalty you must have held a Roth IRA for at least five years.

For 2022 the maximum annual IRA. A Roth IRA is an IRA that except as explained below is subject to the rules that apply to a traditional IRA. Subtracting this from 1 gives 085 for the taxable portion of the account.

Without distribution Roth IRAs can. However Roth IRA withdrawals are not mandatory during the owners lifetime. The Roth IRA calculator defaults to a 6 rate of return which can be adjusted to reflect the expected annual return of your investments.

Titans Roth IRA calculator gives anyone the ability to project potential returns from a Roth IRA retirement account based on your current age how much you plan to contribute each year the. In some situations an early withdrawal may also be subject to income tax or a. For married couples filing jointly the tax brackets are.

First say that youre 55 years old and opening a Roth IRA for. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset. This tool is intended to show the tax treatment of distributions from a Roth IRA.

This means your taxable IRA withdrawal will be taxed at 24 percent. If you satisfy the. Age 59 and under.

Reviews Trusted by Over 45000000. Ad Diversify Your Retirement Portfolio by Investing in a Precious Metals IRA. If you take an early withdrawal from a traditional IRAwhether its your contributions or earningsit may trigger income taxes and a 10 penalty.

Discover The Answers You Need Here. The amount you will contribute to your Roth IRA each year. Roth IRA Taxable Distribution Examples.

Only Roth IRAs offer tax-free withdrawals. For example if you contributed to your Roth IRA in early April 2020 but designated it for the 2019 tax year youll only have to wait until Jan. After turning age 59 ½ withdrawals from Roth IRAs are penalty-free.

If you decide to withdraw 10000 multiplying by 085 gives a taxable IRA withdrawal amount of. The income tax was paid when the money was deposited. You cannot deduct contributions to a Roth IRA.

The Roth 401 k allows contributions to a 401 k account on an after-tax basis -- with no taxes on qualifying distributions when the money is withdrawn. Here are some examples of how Roth IRA distributions may be taxable. 10 percent for income between 0 and 19050.

When a Roth IRA owner dies some distribution rules can apply to whoever inherits that Roth IRA. However you may have to pay taxes and penalties on earnings in your Roth IRA. Roth IRA Withdrawal Rules.

The calculator will estimate the value. Roth IRA Distribution Tool.

Pin On Retirement

Retirement Withdrawal Calculator How Long Will Your Savings Last In Retirement Updated For 2020 Investing For Retirement Personal Finance Lessons Spending Money Wisely

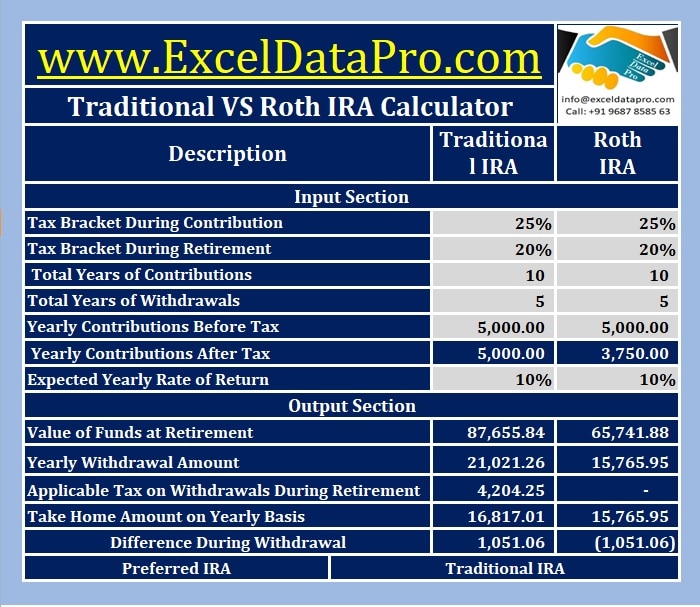

Download Roth Ira Calculator Excel Template Exceldatapro

Traditional Vs Roth Ira Calculator

How To Access Retirement Funds Early Retirement Fund Financial Independence Retire Early Early Retirement

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

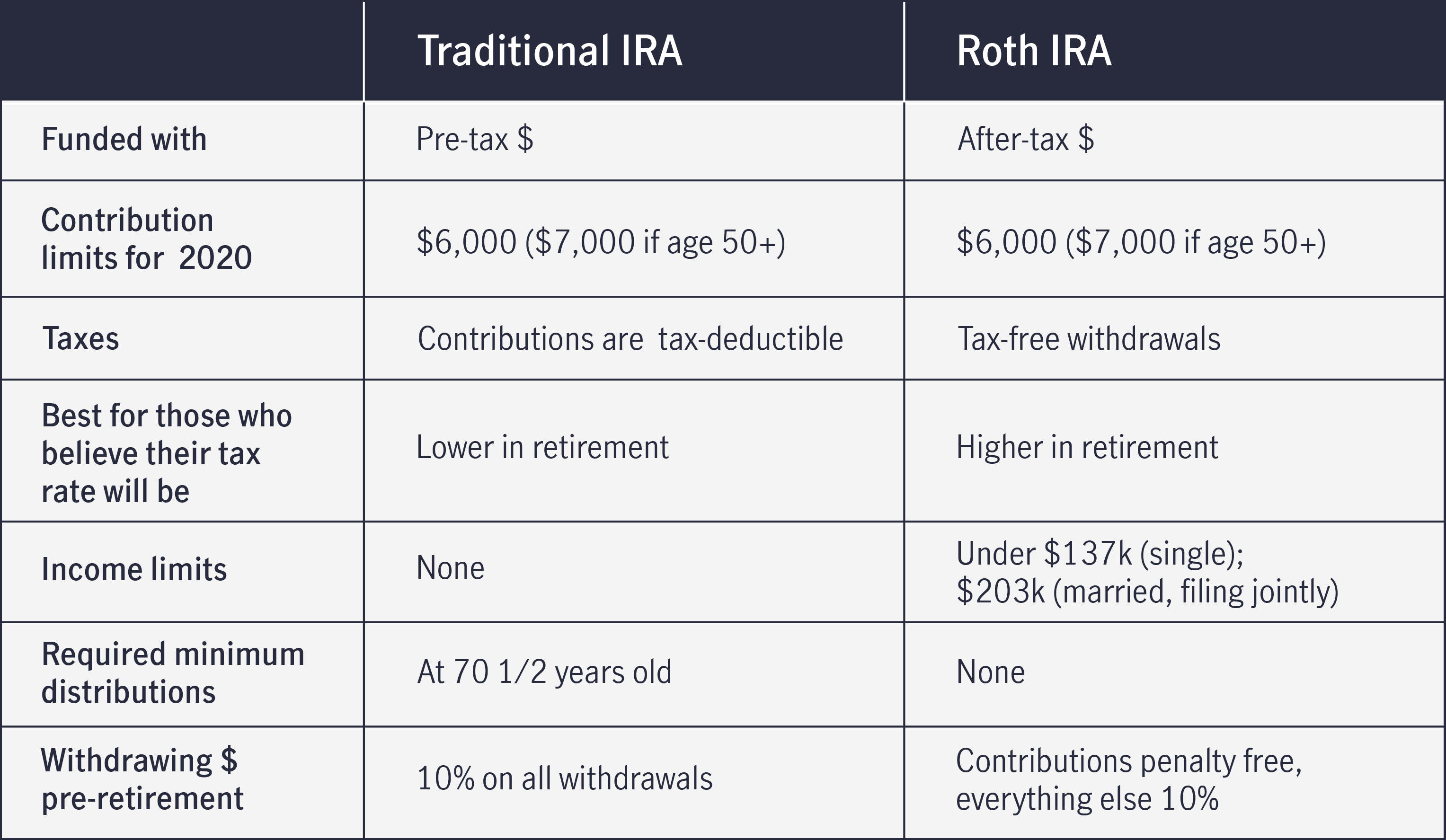

Comparing Traditional Iras Vs Roth Iras John Hancock

Roth Ira A Basic Guide Nerdwallet Self Employed Retirement Plans Investing Retirement Savings Plan

When Can I Retire Early Retirement Fire Calculator Engaging Data Retirement Calculator When Can I Retire Early Retirement

Roth Ira Calculator Excel Template For Free

Roth Ira A Basic Guide Nerdwallet Self Employed Retirement Plans Investing Retirement Savings Plan

/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

The Optometrist S Guide To Roth Ira Chapter 1 Introduction And Backdoor Roth Ira Ods On Finance

Traditional Vs Roth Ira Calculator

Roth Ira Withdrawal Rules Oblivious Investor

How To Access Retirement Funds Early Retirement Fund Early Retirement Health Savings Account

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro